Annual Report 2023

Introduction

As I wrap up my second year of investing, I believe it's beneficial to reflect on my journey and share insights with my audience. While I'm still navigating the early stages of investing, the journey has been filled with invaluable lessons. As seasoned investors often advise, mistakes are essential for growth in this realm. While I started with enthusiasm, some decisions have taught me the importance of caution and thorough analysis. I've become acutely aware of the concept of opportunity cost, especially given the myriad asset classes available in today's market landscape. My intention isn't to flaunt my successes but rather to candidly discuss the challenges I've faced and the patterns I've observed. My aim is to provide clarity on specific topics and events, hoping to enlighten those seeking a deeper understanding. I trust you'll find value in this reflection and glean useful insights from it.

My Performance:

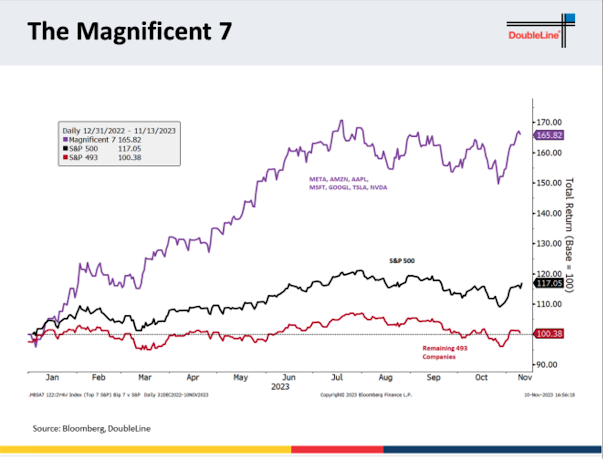

To avoid excessive self-promotion, I'll be brief in this segment. Contrary to Wall Street's initial expectations, both the S&P 500 and the broader stock market flourished this year. The surge can largely be attributed to the performance of the "Magnificent Seven": Nvidia, Meta, Tesla, Amazon, Google, Microsoft, and Apple. Holding any of these stocks likely meant you surpassed the market's performance. Later in this section, I will share a chart contrasting the returns of these seven giants with the other 493 companies in the S&P 500. Fortunately, I've invested in six of these standout companies. This allocation contributed to an impressive year-to-date return of approximately 54% for me, compared to the S&P 500's 24% as of December 20, 2023. While I don't anticipate consistently outperforming the market throughout my investing journey, I'm genuinely proud of this notable achievement.

Top 5 Performing Stocks in My Portfolio:

1. Nvidia ($NVDA) +240%

2. Meta ($META) +183%

3. CrowdStrike ($CRWD) +147%

4. Shopify ($SHOP) +115%

5. Zscaler ($ZS) +100%

My Transactions:

Having a long-term perspective minimizes the frequency of necessary transactions, aligning with a buy-and-hold approach to observe developments. Nonetheless, when holding individual stocks, constant vigilance on your company's performance is imperative. I'll illustrate two scenarios where businesses were deteriorating, prompting a redirection of capital to potentially yield superior returns.

Sell #1: Lumen Technologies ($LUMN)

In my inaugural year of investing, I bought Lumen without a clear strategy, enticed by its impressive dividend yield. Entering the investment with the hope of generating substantial income from dividends, my expectations were high. However, a few years down the line, I find myself selling the position at a significant loss, realizing that the anticipated income did not materialize as expected. This experience taught me a valuable lesson: avoiding the pursuit of high yields. While high dividend stocks may offer attractive income, they often indicate underlying financial struggles within the company. In my investment journey, I encountered this issue with two companies—Lumen (which I sold) and AT&T (currently down). Companies offering high dividends may use this as a tactic to attract investors, but it can also be a warning sign of financial distress, potentially leading to dividend cuts for cash conservation. As for Lumen, despite initially hoping for a turnaround, the company faced persistent challenges, ultimately selling off its European business. With declining revenues, deteriorating profitability, and fierce competition in its industry, Lumen lacked a competitive advantage and seemed to be losing market share. In light of these factors, I decided to sell the company at a substantial loss. I redirected the remaining capital into Mastercard ($MA).

Sell #2: Intel Corporation ($INTC)

I've maintained my position in Intel for more than two years due to its commendable dividends and strong market presence, making it a preferred choice for conservative investors. However, my preference leans towards companies with greater dynamism and growth potential. Consequently, I divested my Intel holdings in Q4, a decision I believe was well-informed. Upon evaluating competitors in the same sector, I found that some outperformed Intel. While the Biden administration emphasizes domestic chip production and restricts sales to China, it's essential to recognize that an election could shift this stance. Additionally, I was concerned about Intel's poor return on its R&D investments. Despite spending $16.5B on R&D, which is nearly double that of its closest competitor (as indicated below), its sales growth has been lackluster over the past ten years. I suspect much of the recent stock enthusiasm was due to government subsidies. Given these factors, Intel's financials didn't align with my investment strategy, and I believe other competitors offer better growth prospects for the long term.

2024 Outlook: Tale of Two Divergent Possibilities

Anticipating the future has consistently proven elusive throughout history. While investing is commonly associated with analyzing financials and economic indicators, there exists an often overlooked aspect. A closer examination of the stock market and economic history reveals repetitive events aligned with specific metrics, affirming the adage that history repeats itself not only in investing but holistically. Additionally, the psychological dimension of investing is frequently underestimated. As I delve into the study of the psychology of money, I am realizing its crucial role in shaping investment decisions. After careful consideration, I've distilled two distinct scenarios for the potential outcomes in 2024. Interestingly, these scenarios differ significantly, not intending to present a dual-sided opinion of the market either rising or falling. Instead, I've scrutinized historical trends relevant to our current economic standing, leading to the identification of two plausible outcomes.

Outcome #1: Stock Market Trends up in Election Years

Comments

Post a Comment