Annual Report 2023

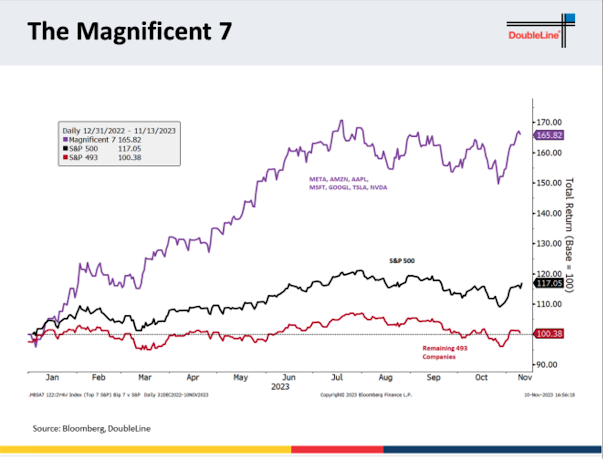

Introduction As I wrap up my second year of investing, I believe it's beneficial to reflect on my journey and share insights with my audience. While I'm still navigating the early stages of investing, the journey has been filled with invaluable lessons. As seasoned investors often advise, mistakes are essential for growth in this realm. While I started with enthusiasm, some decisions have taught me the importance of caution and thorough analysis. I've become acutely aware of the concept of opportunity cost, especially given the myriad asset classes available in today's market landscape. My intention isn't to flaunt my successes but rather to candidly discuss the challenges I've faced and the patterns I've observed. My aim is to provide clarity on specific topics and events, hoping to enlighten those seeking a deeper understanding. I trust you'll find value in this reflection and glean useful insights from it. My Performance: To avoid excessive sel...